Lessons learned from our first 800 Open Accounting borrowers

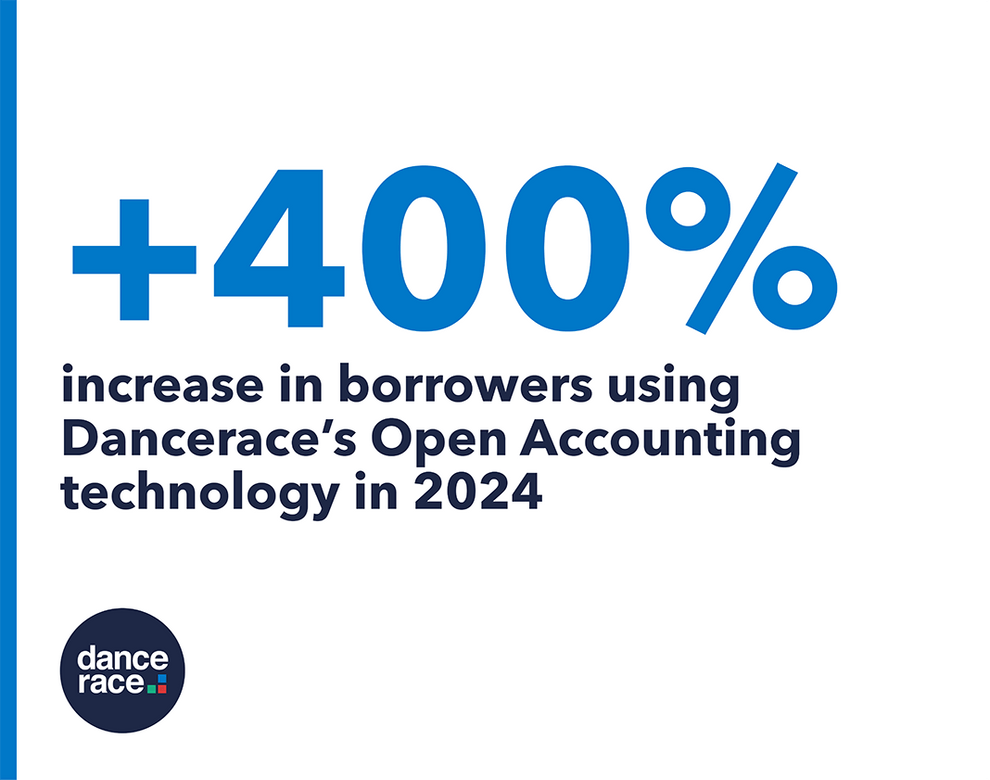

A quiet revolution is brewing in invoice finance businesses across the UK. Over the past five years, we’ve seen a surge in the number of lenders using Open Accounting to streamline their risk management, operations and borrower experience.

Today, close to 900 borrowers use our Open Accounting technology – powered by Codat – across factoring, ID and shadow-type products.

It’s easy to see why. Open Accounting technology – sometimes called ‘data extraction’ – gives lenders direct access to clients’ financial data and MI. With Open Accounting technology enabled, borrowers no longer need to compile and upload ledger data each month. Lenders stay closer to their risk and work more efficiently, every day. In some cases, Open Accounting removes lenders' need for month-end recs entirely.

While all of the invoice finance lenders we speak to see the benefits of Open Accounting, not all of them have implemented the feature in their business. This represents an opportunity. There’s still time to implement Open Accounting to differentiate yourself with a smoother borrower experience and benefit from smarter day-to-day operations.

Here’s how to make Open Accounting work for you, based on our experience of implementing the technology for close to 900 clients. I’ve also recorded a version of this article as a podcast, here.

Start with what you know

Open Accounting has opened up new product opportunities for IF lenders, including our automated shadow facility type, eSync. But Open Accounting also offers powerful benefits for conventional product types like factoring and ID. For example: enabling Open Accounting for a bulk ID client means lenders can validate a client’s bulk figure at any point in the month.

Switching to Open Accounting can feel like a big change for lending teams. So, we advise lenders to implement data extraction with a product that they’re familiar with first, to get them comfortable with how Open Accounting will work for them and their clients.

We’ve written a blog on this, here.

Pick your super-users

Everyone learns at a different pace. We recommend training a small number of ‘super-users’ to understand and troubleshoot Open Accounting issues during the first months of implementation. These super-users can support employees that are unsure about data extraction.

Get sales on side

When we discuss data extraction with lenders, sales teams tend to be the first to understand the power of Open Accounting. They know clients want fast, frictionless borrower experiences. Sales teams are therefore often the biggest advocates for Open Accounting within lending and banking businesses. Equally importantly; sales teams can help your new clients understand and appreciate the power of Open Accounting before onboarding them.

Choose your first clients wisely

The power of Open Accounting is that it gives lenders access to borrowers’ data. This can be perceived as an problem, too. If a client has poor accounting data then their extracted data will be poor. To avoid this issue, start with clients whose accounting you trust. These may not be your favourite or longest-standing clients!

Choose the right accounting systems

Open Accounting technology takes data from a wide range of accounting systems and converts it into a format that your lending platform can work with. That means that when an accounting system provider like Xero or Quickbooks updates their system, the Open Accounting technology must be updated, too. This is more of an issue with some accounting systems than others.

We’ve seen several lenders pause their roll-out of Open Accounting because of an issue with the data presented by one client accounting system. Your Open Accounting technology provider will be able to advise you which accounting systems work best. Start by working with the accounting systems that are least problematic and most common among your lenders, for best results.

Finally, incentivise your team

I hope these tips are helpful. If you’re a lender that has struggled to realise the benefits of Open Accounting for your business, get in touch. I’d love to help!