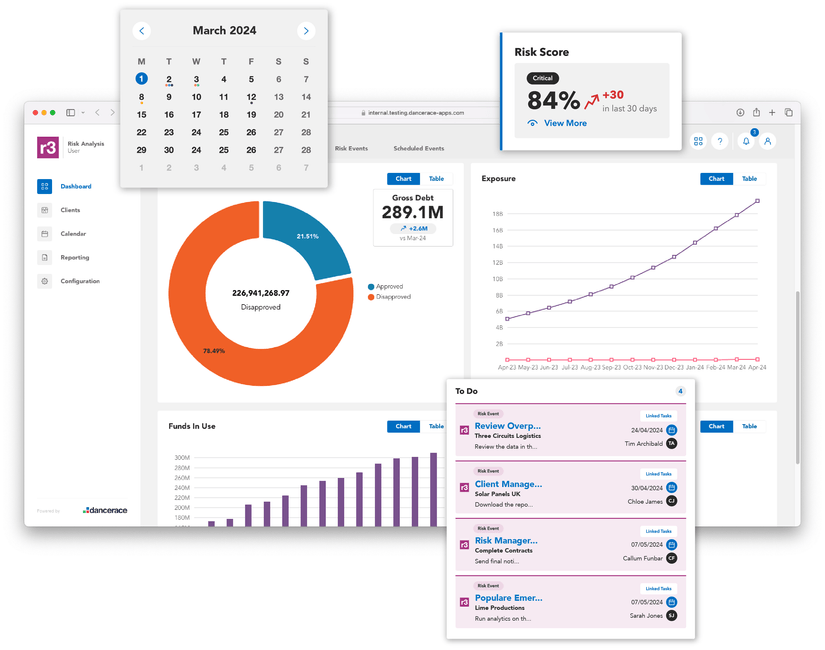

r3 RiskOps: intuitive, end-to-end risk management for invoice finance

r3 RiskOps gives IF lenders of all sizes the tools to model, monitor and act on client risk from a single, intuitive system.

This puts risk at the centre of planning and decision-making across your lending business, including everyday operations and client management.

We call this integrated approach RiskOps – our unique model for helping lenders to cut client and operational risk, and grow their business without growing their team.

Configure your business’ unique credit risk model, including the metrics that matter to you. r3 is flexible: you can even set different models for different clients or client groups.

Track your lending risk across your client portfolio, using your unique risk model. Identify new threats early. See how individual clients’ risk is changing.

r3 RiskOps shows you your highest risk clients, according to your risk models. Armed with this information, your ops and client teams can focus on these clients and work more efficiently, every day.

When a risk event occurs, r3 RiskOps triggers custom workflows for your risk, ops and client teams to respond inside the system. Intuitive task, note and calendar tools make risk management easy.

Cuts client and operational risk

Until today, invoice finance teams have had to monitor their risk and manage their portfolio in separate systems. Data is moved between systems, which causes risk of errors. Credit risk teams can’t easily see what’s happening in client and operational systems, where new risks can emerge. And if systems and teams are un-co-ordinated, risks are missed.

r3 RiskOps is embedded in our complete, connected invoice finance OS. Lending teams model, monitor and manage risk in one place. Data is shared between our backoffice and client systems, and actions taken in one system are mirrored across systems. No moving data. No mistakes made. Nothing missed.

This way, r3 RiskOps is the only system that enables IF lenders to cut client risk and operational risk.

Designed to be different

Other invoice finance risk management systems require specialist knowledge and are difficult to use.

r3 is different. It gives your credit risk team the flexibility and confidence to apply their expertise, configure unique risk models and stay close to portfolio risk. In the same system, your client and ops teams have the tools they need to stay on top of client management and respond to risks without switching between tools.

r3 RiskOps uses our next-generation UI (User Interface) to make risk management intuitive and effortless for everyone in your lending business. For the first time, banking and lending teams have access to sophisticated risk tools in a system that feels like a smartphone app.

Flexible & functional

Only dancerace can offer this combination of functional depth and user-friendly design, after 30 years of invoice finance software innovation. Work smarter with r3 RiskOps:

- Understand your portfolio risk in a glance, via your risk dashboard

- See your highest risk clients at any time, in your risk activity feed

- Configure unlimited risk covenants and metrics for individual clients and product types

- Manage and track your team’s response to risks using kanboard boards, tasks and notes

- Move seamlessly between systems via SSO

The big idea:

RiskOps

In our latest lender briefing, Dancerace’s Head of Product Jon Watts makes the case for RiskOps: the alternative operational model for invoice finance lenders that inspired our r3 RiskOps system.

RiskOps puts risk at the heart of decision-making for leadership, risk and ops teams in invoice finance businesses, to help them manage risk more effectively and work more efficiently, every day.

Read our short briefing paper today to find out more.

Speak to our IF risk experts today

Our team of risk management and invoice finance experts designed and developed r3 RiskOps in collaboration with lenders across the globe. Make risk management easier, more effective and more efficient. Grow your lending business without growing your team To understand if r3 RiskOps is right for your business and to see the system in action, get in touch today.

Europe

Walcot Yard

Bath BA1 5BG

United Kingdom

Asia-Pacific