See what your clients see: Introducing our new ‘Insights’ system

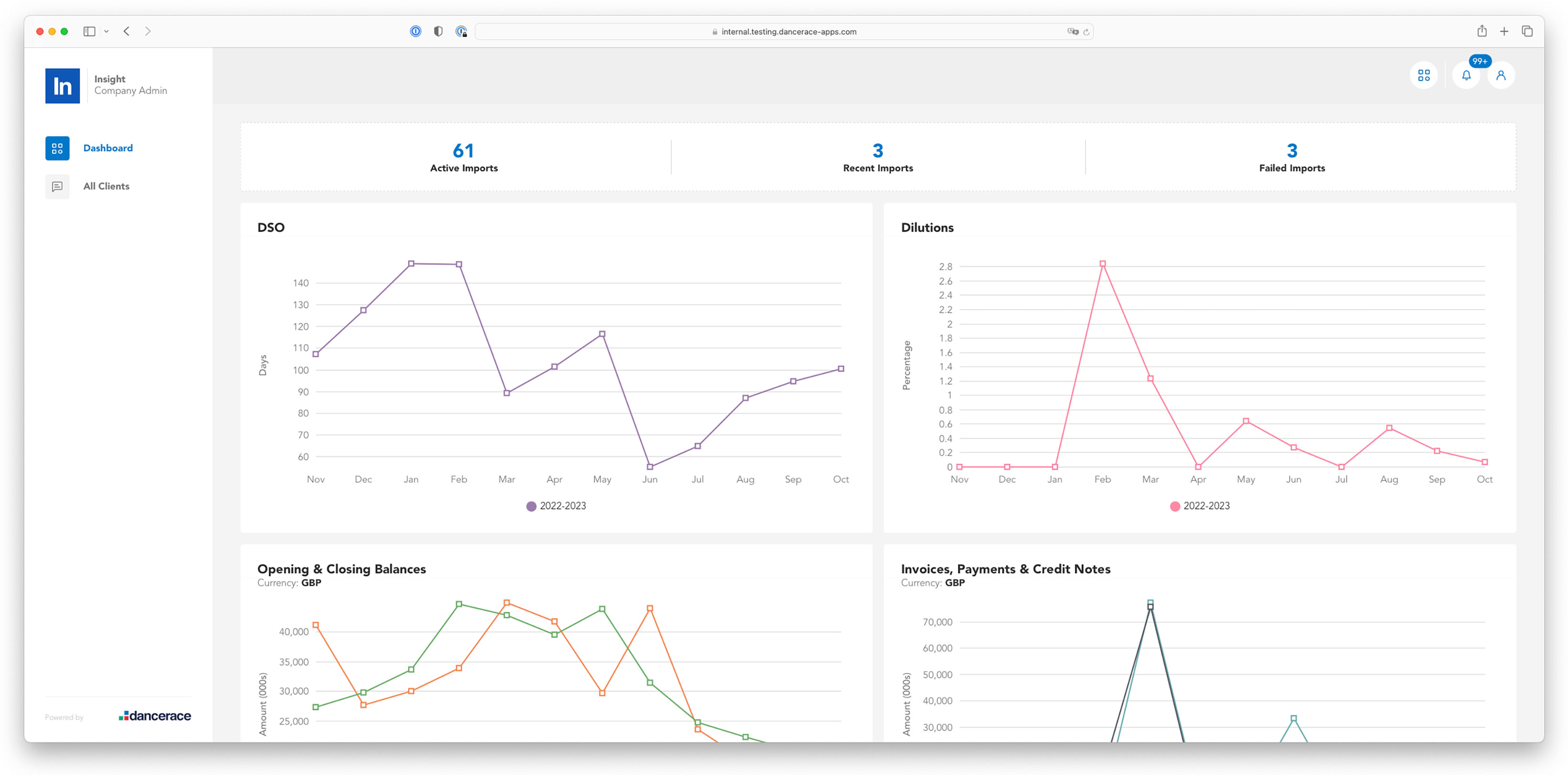

For lenders, Open Accounting technology lifts the lid on clients’ everyday financial data. Our new Insights system makes this data accessible and understandable for lending teams, enabling them to make better lending decisions and spot risks sooner when operating a wide range of ABL products.

How does Insights work?

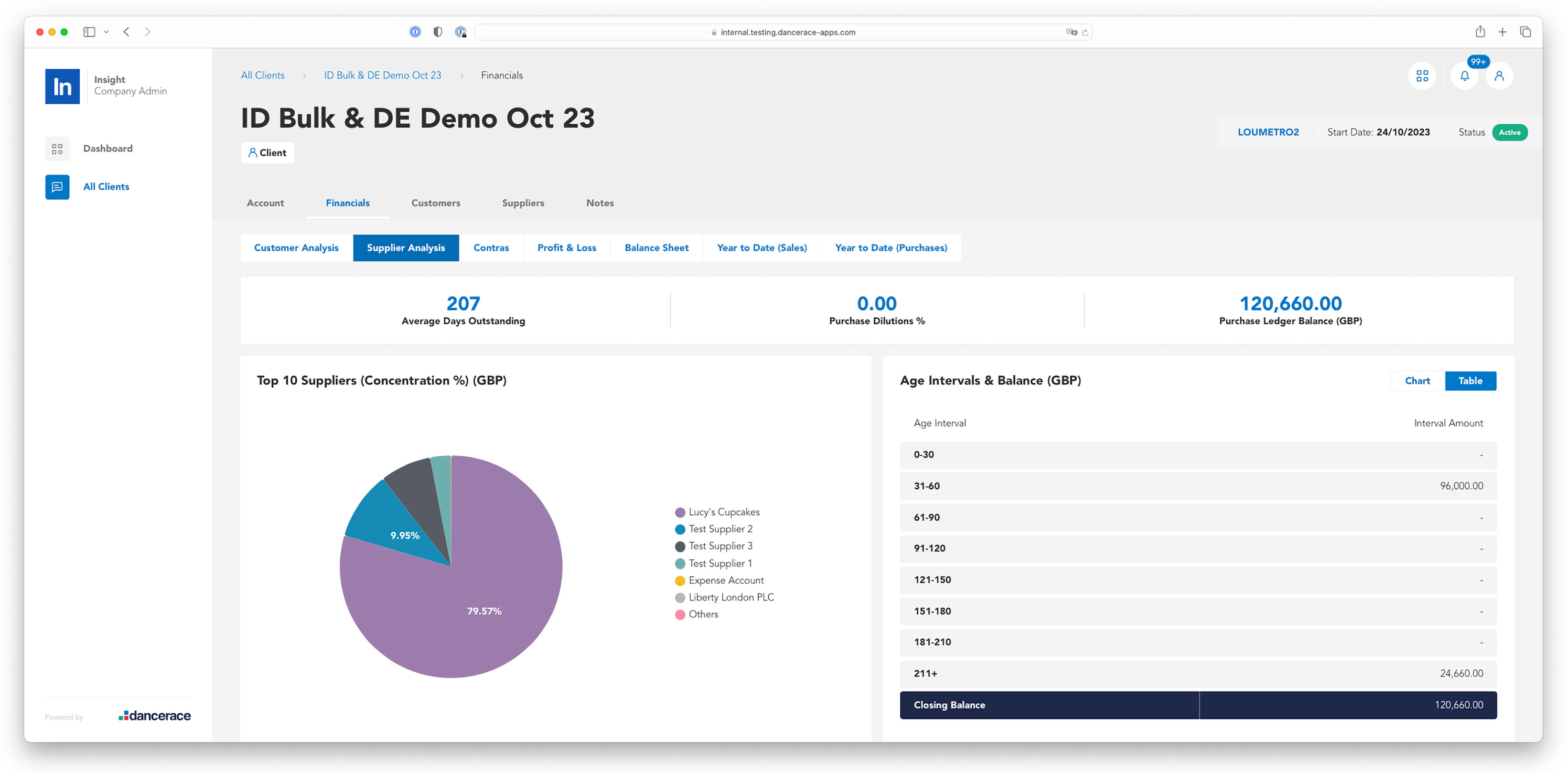

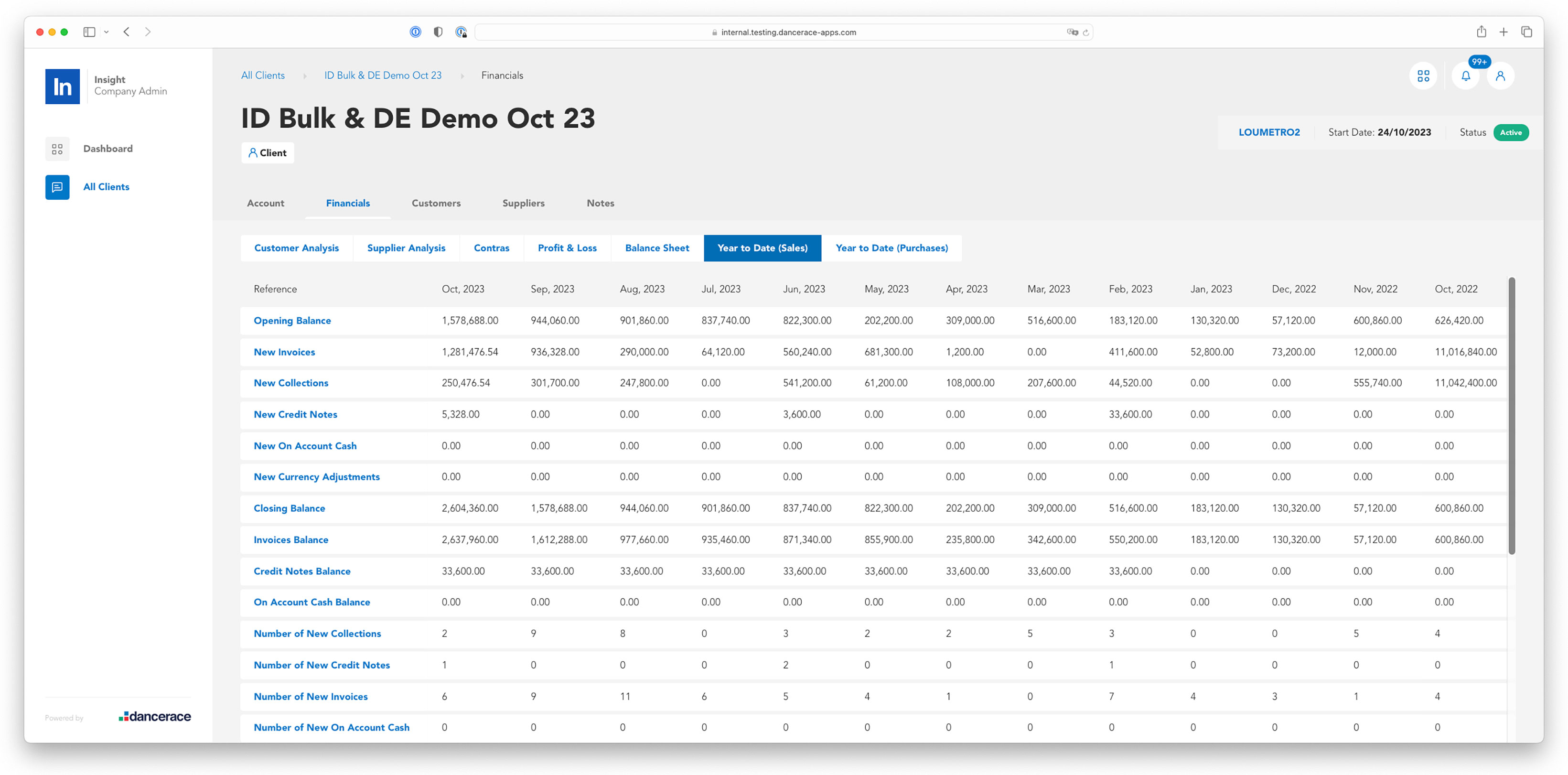

Insights is a data dashboard within Dancerace’s c3 Backoffice Control system. Insights takes the Open Accounting data extracted from clients’ accounting systems and presents it in a range of easy-to-understand tables and charts, for everyday analysis by lending teams.

Lenders have access to rich data from their clients’ online and offline accounting systems, including:

- Ledger data, to invoice line-level

- Financial performance (sales and purchases analysis, contras, YTD sales and purchases)

- Management information (balance sheet and profit & loss)

Insights displays financial data from the latest data ‘extraction’ from each clients’ accounting system. Lenders can configure their system to trigger a new upload from their clients’ accounting system automatically on a scheduled basis, or can ask their clients to trigger an extraction manually.

Lenders also have access to the accounting information in Insights when underwriting new clients using our f3 Client Onboarding system - part of our commitment to deliver the benefits of Open Accounting at all stages of the lending lifecycle.

Who is Insights for?

Visibility of clients’ latest accounting data benefits teams across banking and lending businesses. Insights is compatible with a wide range of ABL facility types in our c3 Backoffice Control system, including factoring, invoice discounting and more:

- Relationship teams spend less (or zero!) time requesting, collecting and compiling clients’ financial data. Less administration means more time spent offering value to clients. And because the data comes direct from clients’ accounting systems, it’s less likely to be subject to mistakes or manipulation.

- With up-to-date information on clients’ creditors, debtors and management accounts, lenders can spot and react to issues, fast. For bulk invoice discounting facilities, for example, lenders need no longer wait until month-end to understand movements in their clients’ accounts. Auditors can analyse clients’ financials at any time, without asking clients for data.

- With an in-depth view of clients’ finances, lenders can see when clients’ facilities no longer match their needs and spot opportunities to offer new products.

Insights gives lenders much more data than they previously had from their clients, with no extra work required from borrowers. To get set up, clients connect their accounting system once and their Open Accounting connection is ready for action. This removes the need for clients to repeatedly compile and upload ledger data on a weekly or monthly basis. This is especially useful for offering factoring-type facilities, which otherwise require clients to upload their data most frequently.

Better for borrowers, better for lenders! To see Insights in action, contact our expert lending team today.