Shine a light: What frictionless data transparency means for control, customer service and access to capital

At Dancerace, we’ve put frictionless data transparency at the centre of our vision for better lending. Here’s how it helps lenders and their funding providers to deal with challenges today and unlock new opportunities for tomorrow.

Definitions, first: What do we mean by ‘frictionless data transparency’?

We mean making borrowers’ management information (MI) visible to both lenders and lenders’ upstream funding provider, automatically.

Lenders can use technology to achieve this in a range of ways:

- By using data extraction to connect to their customers’ accounting system and collect their MI automatically.

- By compiling the relevant data into an internal report or dashboard automatically.

- By sending the MI to their funding provider for further processing, automatically, using an API, Secure File Transfer Protocol (SFTP) or similar communication method.

The Dancerace ABL operating system supports all these named methods of collecting, reporting and sending data, to achieve frictionless data transparency.

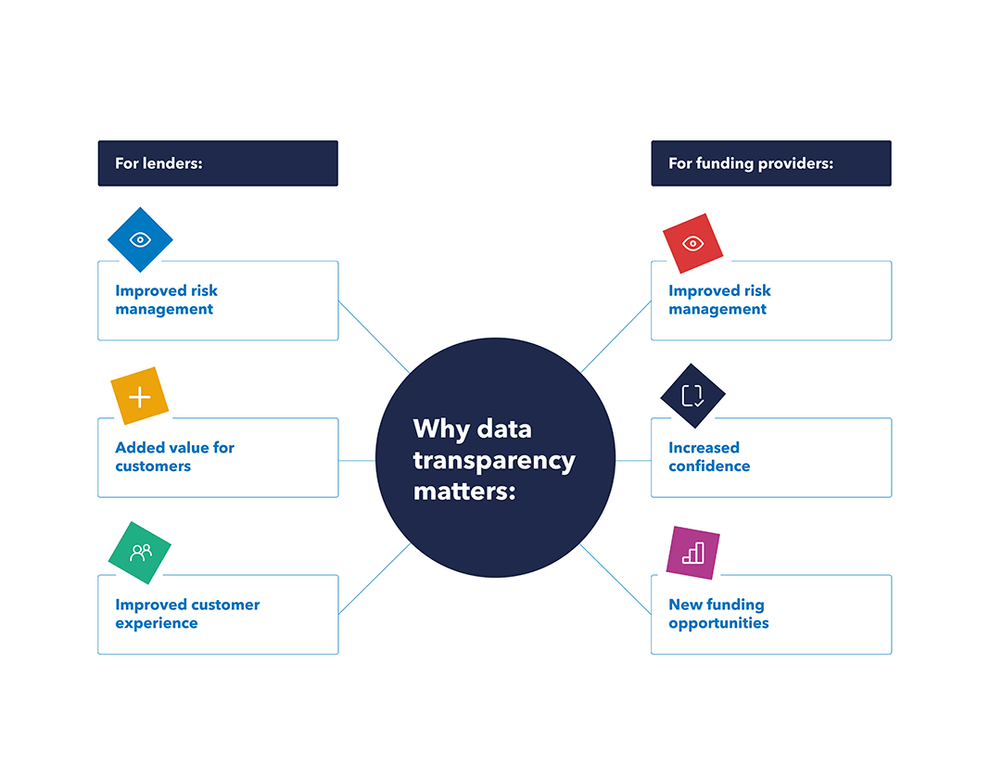

What value does this create for lenders and funding providers?

For lenders: Improved control and customer service

For lenders, having ready access to customers’ MI is critical to their ability to manage risk. With high quality, up-to-date information, lenders can spot and respond to issues more quickly, keeping them in control of their portfolio.

This increased visibility creates new opportunities for lenders to offer value to customers. With a clear window into their borrowers’ finances, lenders can spot where customers need financial support and suggest relevant products.

Automation improves the customer experience further. With data extraction, borrowers no longer need to upload or email their ledger to their lender. Data extraction collects their data directly.

Automatic data processing saves time for lenders, too – freeing up staff to spend more time on high-value activities like customer engagement and less time on manual administration.

This is especially impactful when it comes to upstream reporting – among the most time-consuming tasks for lenders. Delays and mistakes in compiling and sending data to funders can quickly lead to business-critical issues for lenders. Data transparency solutions that automatically collect, report and send customer MI to funding providers therefore save lenders considerable time, hassle and risk.

Could frictionless data transparency also improve lenders’ ability to access funding, by making funding providers’ lives easier?

For funding providers: Confidence and new opportunities

Over the past decade, we’ve seen a marked increase in the number of financial institutions choosing to access ABL markets by providing back-to-back funding to lenders.

In this arrangement, convenience is key. But so is confidence. The further the financial institution is from the business or asset that they’re funding via their lender, the greater their risk.

This is where frictionless data transparency comes into its own. Effective upstream reporting enables funding providers to see and understand what they’re funding, at all times. Automated reporting allows them to respond to risks in their lenders’ portfolios more quickly. Access to an extensive range of data on borrowers enables them to build monitoring systems on top of the ones used by lenders.

Arguably, the more data transparency a lender can offer, the more confident funding providers should be to extend funds. Better for lenders; better for those providing funding.

Beware: The dangers of drunkenness

The value of data transparency for lenders and funding providers is, well, transparent.

Many teams have therefore rushed into the reeds to gather as much borrower data as possible.

But this causes new problems: something I like to call being drunk with data. Too little data leaves lenders and funding providers in the dark. Too much data can be overwhelming and confusing.

It’s up to technology providers like Dancerace to help you find and compile the data that matters to your business, and in doing so unlock the power of the data in your portfolio. Ready to get started?

This article originally appeared in the February/March 2023 edition of Business Money magazine.