It’s here! Introducing r3 RiskOps for invoice finance

After four years in development, we’re pleased to announce the launch of r3 RiskOps – the final element in our complete, connected software OS for banks and lenders offering invoice finance products.

What is it?

r3 RiskOps is our intuitive, end-to-end risk management system for teams offering factoring, invoice discounting, selective invoice finance (SIF), trade, construction and recruitment finance products.

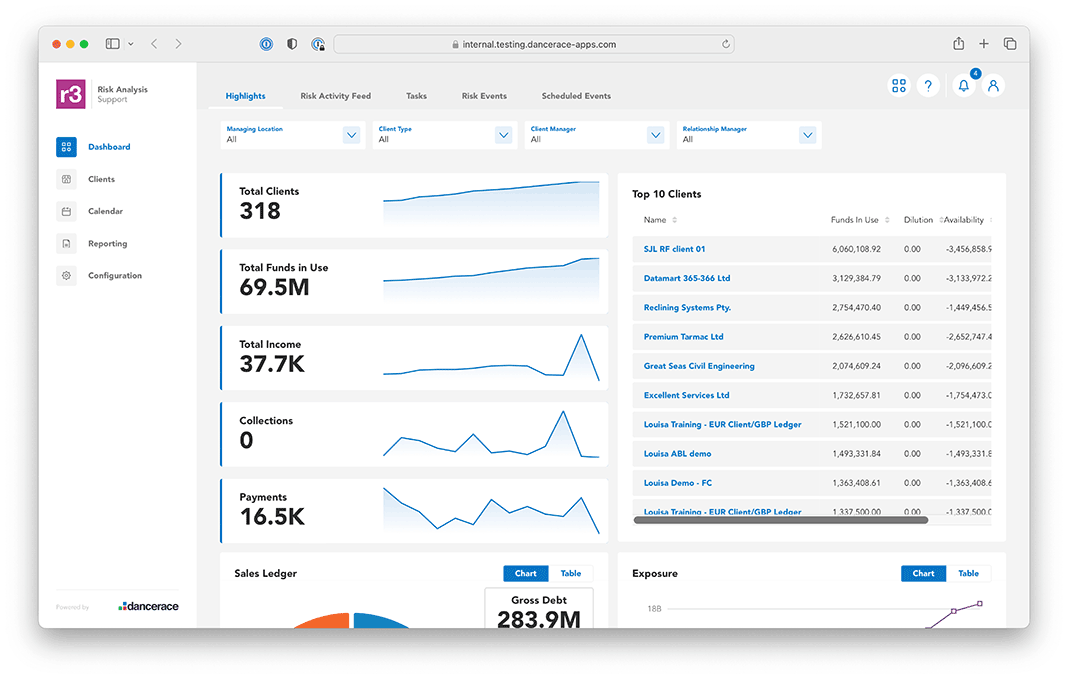

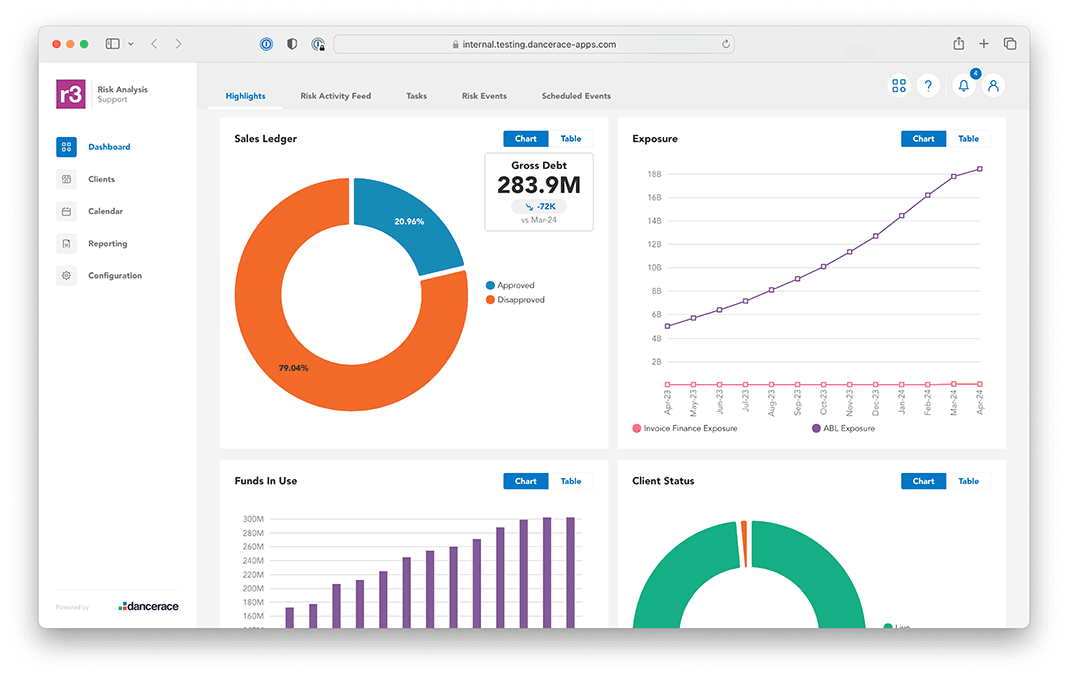

r3 helps lenders to manage their client and operational risk, by monitoring their portfolio and alerting users when risks emerge, then enabling them to respond – all from a single system.

Who’s it for?

Other risk management systems are designed for credit risk teams only.

r3 is different: it’s designed to be used by everyone in your lending business, to embed risk management into everyday decision-making at every level, and across credit risk, ops and client teams.

Better still: we’ve built r3 to be affordable for all lenders – not just banks. With r3, small and medium-sized lenders can fund clients that they might have previously avoided because they didn’t have an effective risk management system.

Having designed and developed r3 in conjunction with our community of lenders, r3 is already live with banks and lenders in the UK and Australia.

CTOEnterprise lender“With r3 RiskOps, we were looking for an integrated risk module within our DF core that would alleviate the need for integration between system and was more commercially attractive than other systems.

We chose r3 for the rich roadmap of future releases, intuitive UX and feature-rich dashboards. So far, the graphical representation of trending analytics, the ease with which portfolios are created and viewed and the ability to sync notes across dancerace systems have been most valuable to us.”

What’s the value?

Until now, banks and lenders offering invoice finance products have had to monitor and manage their portfolio risk in separate systems.

This creates operational risks. Credit risk teams might spot a risk and alert their colleagues in ops and client management teams, who may or may not act on the warning. Employees in any team might fail to spot an issue with their clients.

r3 reduces these operational risks by enabling teams to spot and act on risk in one place – so that everyone knows risks are being monitored and dealt with at all times.

Monitoring and managing risk in separate systems creates risks when employees move risk data from one system to another. Processing data this way also takes time. By cutting teams’ administrative workload, r3 saves teams time and effort.

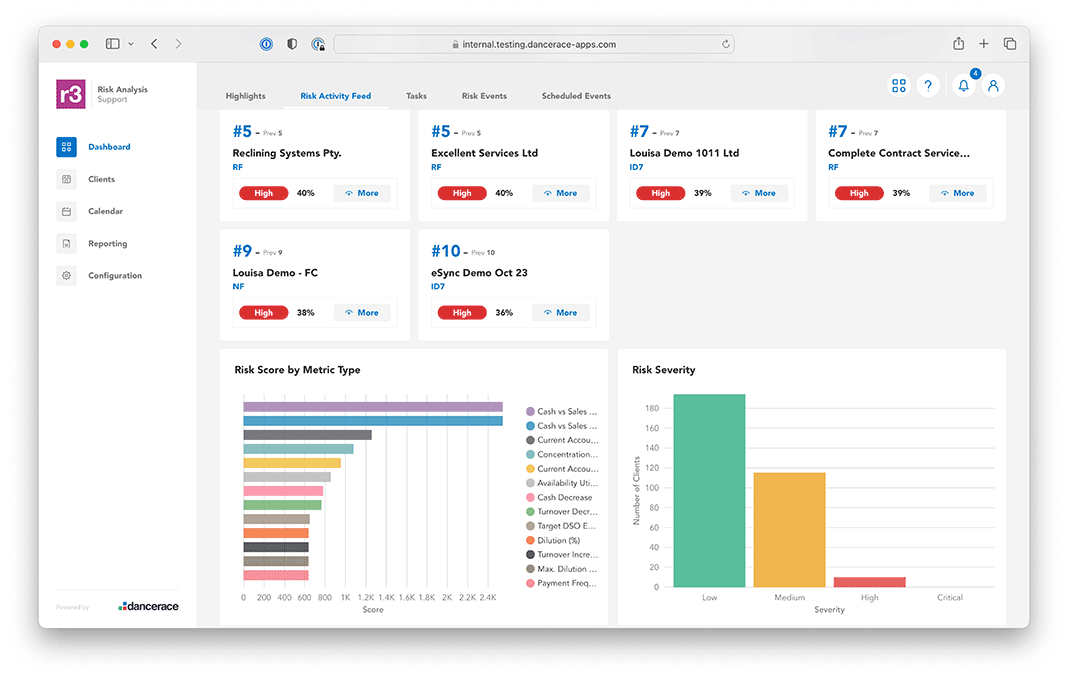

r3 also helps teams to work more efficiently by showing ops and client management staff which clients represent the highest risk at any time. Today, many lending teams audit clients on a scheduled or ad-hoc basis, spending the same amount of time on low-risk clients as on high-risk ones. r3 helps teams to prioritise. Better for staff, better for business.

We call this model RiskOps: an embedded approach to managing invoice finance risk, which cuts client and operational risk and enables teams to work more efficiently.

How does it work?

Unlike other risk management systems, r3 is designed to be intuitive and flexible. We’ve focused on building a best-in-class user experience that makes it easy start managing risk more effectively.

Credit risk teams configure their unique risk model in r3. (Unlike other systems, we don’t make you apply a ‘universal’ risk score that might not reflect your monitoring requirements.)

r3 then tracks activity across your client portfolio. When a ledger event breaches your parameters, workflows are triggered for chosen employees. Work is organised and tracked using intuitive calendar, task management and note views.

No switching between systems; no moving data; no mistakes and nothing missed.

State General ManagerEnterprise lenderWorking with r3 and the wider dancerace OS has enabled us build a ‘suite’ of funding support tools and loan management systems which seamlessly interact with each other and provide reference consistency.

In doing so, we've removed duplication from our systems and have the benefit of an adaptable platform that we can enhance as we move further into the possibilities of Open Banking.

How do I find out more?

We’re launching r3 exclusively to lenders using the dancerace OS, before opening the system to other banks and lenders in coming months.

To find out more and see r3 in action, contact info@dancerace.com today.